5 lessons for raising financially savvy kids

“The greatest gifts you can give your children are the roots of responsibility and the wings of independence.”—Denis Waitley

We all want our children to be good stewards of the bounty God has given and to grow into responsible adults when it comes to money. Yet most of us had little or no formal financial training ourselves. I’m frequently approached by parents who ask, “How do I even begin teaching my child about money?”

Over the years, I’ve gathered practical money lessons and fun training activities parents can use. Keep in mind that, like any learning, their lessons must be age-appropriate. And of course, kids learn best by participation and example, not by being lectured!

Here are five lessons to help your kids learn great money habits—and have fun doing it:

1. Money is Exchanged for Things (ages 4–8)

Kids don’t necessarily make the connection between money and the groceries, clothes and toys that show up in your home—especially if they only see you take that plastic card out of your wallet at the store! Use the following activities to reinforce that connection.

Sort coins and bills together. Depending on their age and math skills, you can have your children stack ten pennies to equal a dime or even have them make change.

Make shopping lists together. Let your child help make the grocery list. Show them how you decide what you’ll need at the store. Explain why you don’t include other items on your list.

Pay cash at the store. Paying cash has two benefits. First, it will help your child grasp the connection between money and buying things. Second, studies show that you’ll actually spend about 20% less—without feeling deprived!

Let your child choose and buy a small item with coins. Let him or her count out the coins for the right amount to the cashier. The extra time this takes will be well worth the confidence your child gains!

2. Creating Spending Plans (ages 4–12)

Even young children can begin to decide how they will spend their money. Older children can set longer term goals and manage larger amounts.

Create “Spend, Share and Save” images. Discuss what each category means. “Spend” is for things they will buy that week (or, for older kids, within that month). “Save” is the money put away for a larger purchase or goal. “Share” is the money they will give to a worthy cause of their choice or tithe to your church. Have them cut out or draw images that represent these concepts for them.

Set simple goals for each category. Young children’s goals must be very simple and not very far out into the future! But even a four year old can set a goal to “save $1.50 for the poor children.” Write these simple goals on a sheet of paper.

Make “Spend, Save and Share” envelopes. Have your child make colorful envelopes for the three basic parts of their spending plan. Every time they receive money, have them immediately divide it into these envelopes.

Create Spending Plans. Children who are a bit older and who have some math skills can graduate from envelopes to create simple spending plans for themselves. (See the “Spending Plan for Kids” example). Start with weekly spending plans; then help them with monthly plans once they get the hang of it.

3. Money is Earned (ages 4–12)

No, money does not grow on trees! But kids don’t necessarily grasp that what you or your spouse do all day while you’re away from home (or from home) is what allows you to put food on the table and toys in the toy box. Help them understand how your family earns money and let them earn some of their own.

Take your child to work. Some employers encourage this; some do not. If you can’t bring your child to the workplace, take excursions to explain what you do. Show them the house Mommy designed or the law books Dad studies to help his clients.

Create a list of kid-friendly chores. Together, decide on small chores they can do to earn extra money. Set a “wage” for each one. Older children can even invoice you at the end of the week. (Make sure you set a limits on what they can earn based on what you can afford so your budding entrepreneur doesn’t break the bank!)

4. Wants Versus Needs (ages 8–12)

Kids much younger than eight will have trouble grasping this lesson—as do many adults I know! But it’s important to help your kids understand the distinction. A need is more connected to survival. A want is a desire that we can certainly survive without.

Distinguish common purchases. Make a list of items that you commonly purchase, everything from bread to new shoes. Have your child rank each on a scale of 1 (just nice to have) to 10 (need to have.) Discuss the rankings without making them wrong.

Play “What’s the Worst that Could Happen?” Using that same list or other items you and your child might want to purchase, ask “What’s the worst that could happen if we don’t get this?”

Share your own Delayed Gratification list: Make a list of all of your personal “wants” that you are delaying for other priorities. Share the list with your children, and explain your reasoning. Encourage them to make their own list.

5. Understand Impulse Buying (ages 8–12)

Again, younger children may not be able to grasp this lesson. But it’s critical for older kids to be aware of how Madison Avenue is trying to manipulate them!

Critique commercials. While watching TV with your kids, ask them what advertisers are trying to get them to do. What is the underlying message? What are they saying will happen if you buy or don’t buy that product? How does the product look in real life (i.e. that Big Mac) compared to the advertisement?

Offer “now versus later” deals. For example, offer your children $5.00 today or $15.00 in two weeks. Which do they want? Talk them through the decision. And if they decide on the $5.00 today, check back with them in two weeks and ask how they feel about that decision.

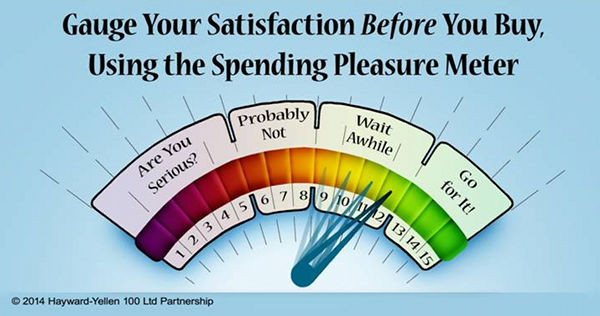

Create a Spending Pleasure Meter. Have your child create a visual that represents how much pleasure they feel about various purchases. It can look like that old carnival game with the bell on top or like a speedometer that shows 0 to 100. (See the Spending Pleasure Meter for an example.) Whatever they come up with, ask them to rate potential purchases on this meter before they head to the store. Ask them to re-rate that purchase a few days later.

I hope you find these lessons and exercises useful. One last note: One of the most important things in teaching your children about money is to allow them to make mistakes, and let them experience the consequences of those mistakes! You’ll find that there is no need to scold or lecture them. If Jimmy blows his allowance on candy so he can’t go to the movies with friends, great! It’s a lesson that will definitely stick. Better to have your children get these tough lessons while they’re still under your care.

Biographical Information

Pamela Yellen is a financial security expert and author of two New York Times best-selling books, including her latest, The Bank On Yourself Revolution. Readers can boost their financial literacy and discover their Financial IQ by taking Pamela’s eye-opening Financial IQ Quiz here: www.BankOnYourself.com/old-schoolhouse-quiz.

Copyright, 2015. Used with permission. All rights reserved by author. Originally appeared in The Old Schoolhouse® Magazine, the family education magazine, Fall 2015. Read the magazine free at www.TOSMagazine.com or read it on the go and download the free apps at www.TOSApps.com to read the magazine on your mobile devices.

Readers’ comments

Comments are automatically closed 14 days after publication.